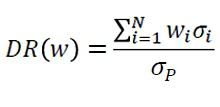

Portfolio diversification formula

It discusses the diversification ratio. Wi the weight of the ith asset.

How Many Stocks Make Up A Well Diversified Portfolio Seeking Alpha

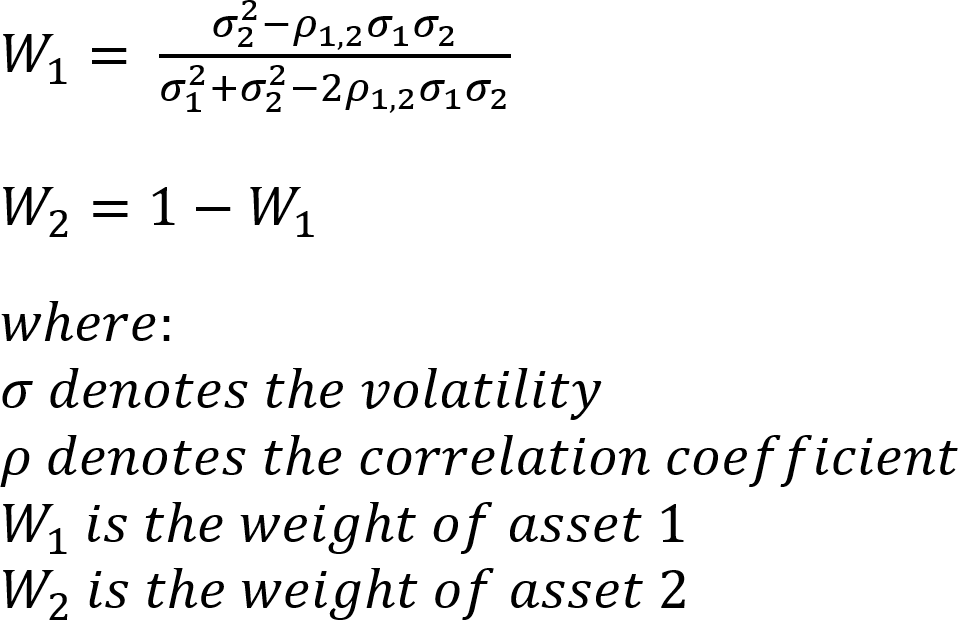

Consider an investor holds a portfolio with 4000 invested in Asset Z and 1000 invested in Asset Y.

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

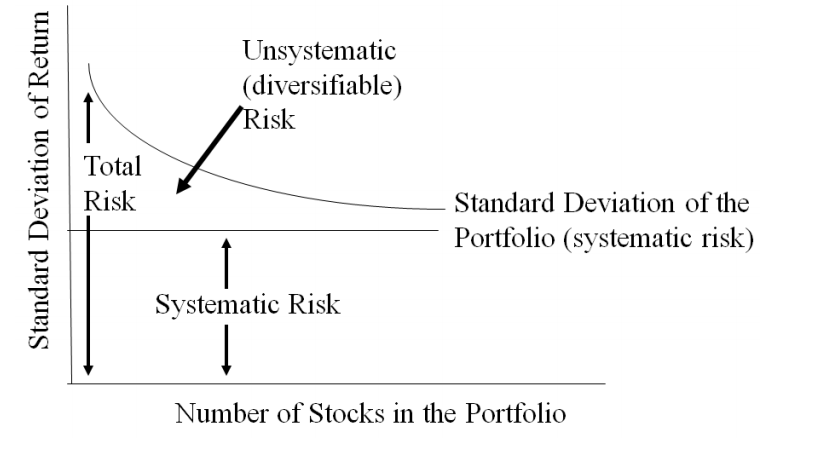

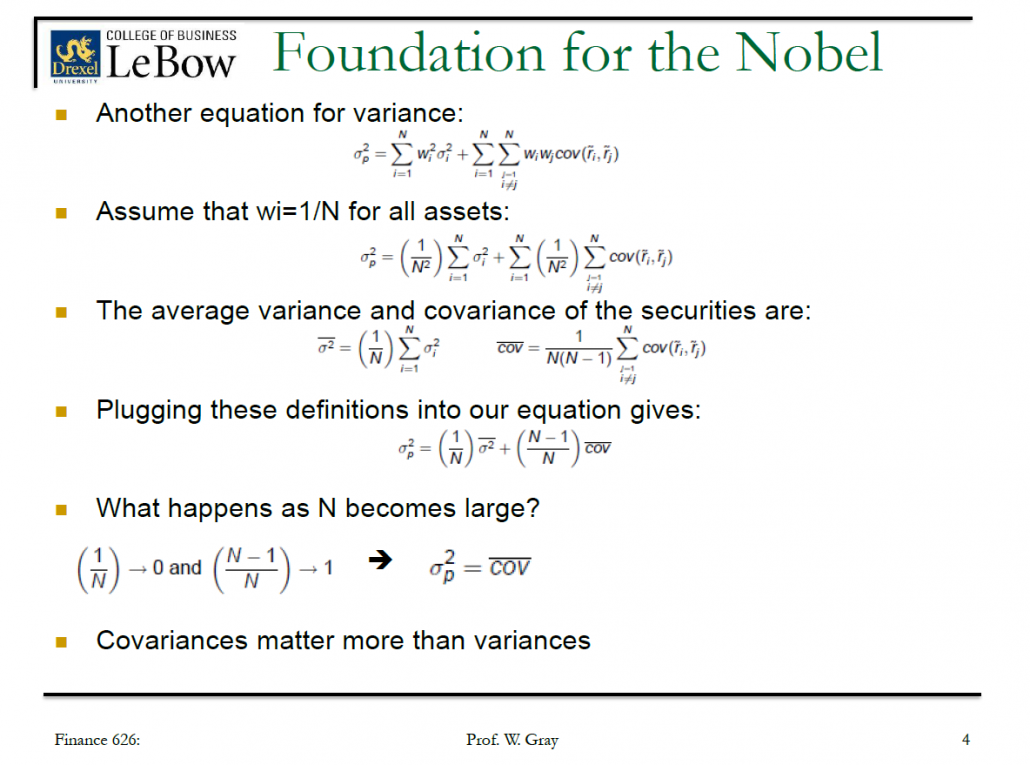

. Too few stocks and one blowup hurts the portfolio by a noticeable amount. Square root of the sum of variance divided by number of. Formula for Portfolio Variance.

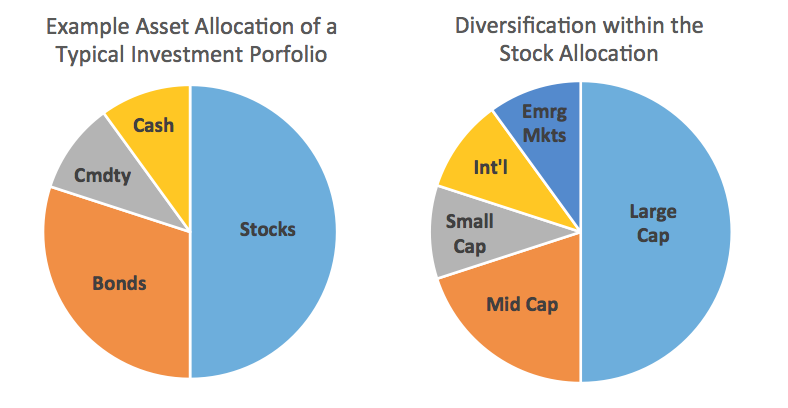

The variability of returns on a portfolio is. Portfolio diversification explains the two-way flow of capital between countries even when interest rates are equalized among countries. Here are five tips for helping you with diversification.

The volatility is calculated as. Too many stocks and you run the risk of a very expensive index fund. This lecture is the Part 03 of series of lectures on Portfolio Management.

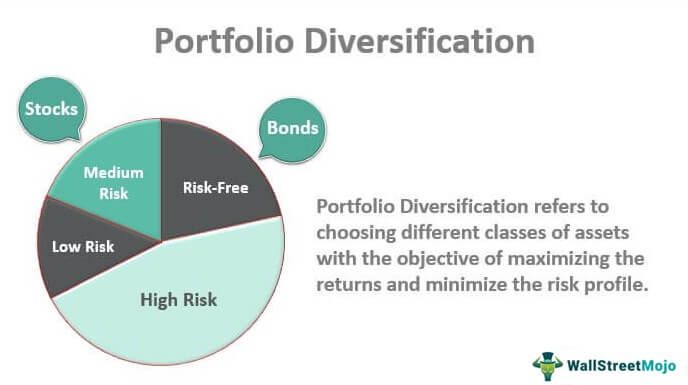

Equities can be wonderful but dont put all of your money in one stock or one sector. Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N.

The correlation coefficient is calculated by taking the covariance of the two assets divided by the product of the standard deviation of both assets. A diversified portfolio contains a mix of distinct asset types. Just imagine what would.

The expected return on Z is 10 and the expected return on Y is 3. If the constituents are equally weighted the portfolio standard deviation ie. With a concentra- tion ratio of 50 the example portfolio has the.

It is computed with the following formula. Portfolio diversification is the process of investing your money in different asset classes and securities in order to minimize the overall risk of the portfolio. A common path towards diversification is to reduce risk or.

It discusses the diversification ratio. The portfolios expected return is a weighted average of its individual assets expected returns and is calculated as. In finance diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk.

The variance for a portfolio consisting of two assets is calculated using the following formula. Where aaljaflkjsfalskfj represents respectively the return observed during period t in months quarters or years etc the average of periodic. E Rp w1E R1 w2E R2 Where w1 w2 are the.

I have written many times.

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

Solactive Diversification The Power Of Bonds

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

:max_bytes(150000):strip_icc()/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Standard Deviation And Variance Of A Portfolio Finance Train

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Time Diversification Redux Research Affiliates

Modern Portfolio Theory 2 0 The Most Diversified Portfolio Seeking Alpha

Finance Portfolio Variance Explanation For Equation Investments By Zvi Bodie Quantitative Finance Stack Exchange

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Investment Analysis And Portfolio Management Lecture 3 Gareth Myles Ppt Download

Portfolio Diversification How To Diversify Your Investment Portfolio

The Portfolio Diversification Effect Youtube

Asset Allocation And Diversification Chartschool